Chapter 7 Debt Limits and Chapter 13 Debt Limits in Arizona

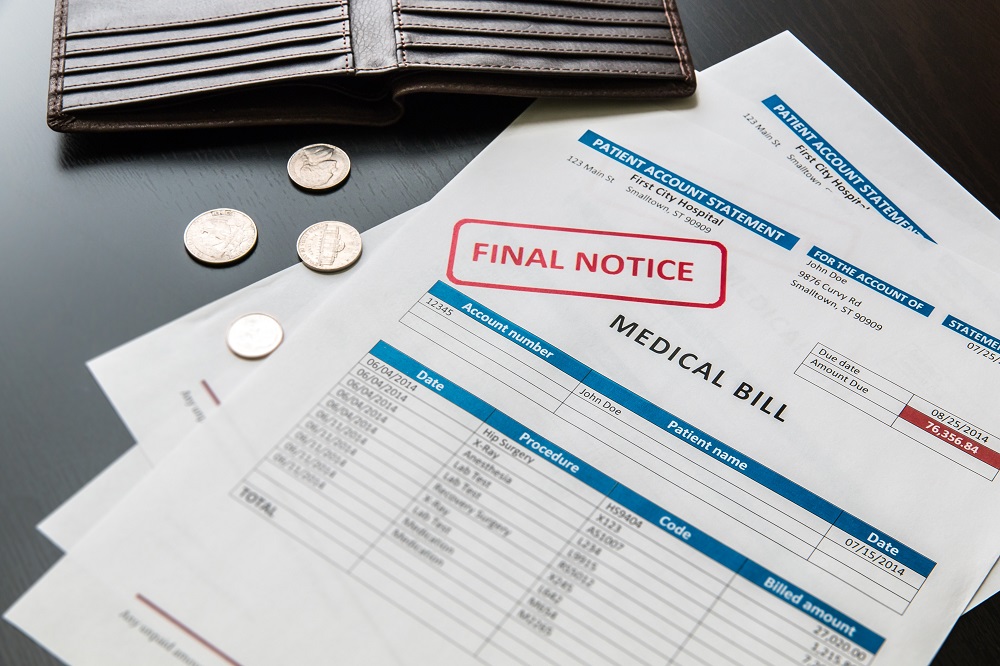

Going through a financially-challenging situation will have you thinking about many aspects of the future. A bankruptcy filing can relieve you from some of the debt burden but do you qualify for it?

Going through a financially-challenging situation will have you thinking about many aspects of the future. A bankruptcy filing can relieve you from some of the debt burden but do you qualify for it?

Both Chapter 7 and Chapter 13 bankruptcy filings come with a debt limit that’s established in the US Bankruptcy Code. These limits are valid in all states and they apply to both secured and unsecured debt.

Chapter 7 Bankruptcy Debt Limit

The good news for all Arizona residents interested in a Chapter 7 bankruptcy filing is that a debt limit doesn’t exist.

In order to quality for Chapter 7 bankruptcy, however, you’ll have to pass the means test. The Arizona means test is used to determine whether the household income falls beneath the mean income in the state. In such instances, a Chapter 7 filing will be possible.

Chapter 7 bankruptcy filings are also freed from a minimum debt requirement. If you don’t have a lot of debt, however, you will need to determine whether the bankruptcy filing is justified. There will be long-term financial consequences of the filing. In case your debt amount is relatively small, pursuing an alternative may be the best choice.

Chapter 13 Bankruptcy Debt Limit

Chapter 13 bankruptcies do feature a maximum unsecured and secured debt amounts.

The Chapter 13 debt limit that will be effective throughout 2018 is 394,725 dollars of unsecured debt and 1,184,200 dollars of secured debt. Adjustments to these values are made every three years. The next adjustment is set for April 1, 2019.

The secured debt limit applies to all kinds of debt, including taxation debt and loans that are secured via personal or real property. Such debts may include mortgages and loans secured through several types of collateral like property, vehicles and equipment (mostly in the case of business loans).

Unsecured debt will usually include credit card debt, lined of credit, medical expenses and unsecured taxes. All other loans that are not covered via collateral will also fall in the unsecured debt category.

If a person exceeds the limits for the Chapter 13 filing, they will have to pursue an alternative. Those who pass the means test could pursue a Chapter 7 bankruptcy filing. A Chapter 11 bankruptcy could also be pursued. It is similar to the Chapter 13 filing because it is also a type of debt reorganization tool. Chapter 11 bankruptcies, however, are considered less streamlined from a legal point of view and they are less popular.

Click here for information on Chapter 13 debt limits in Arizona.

Exceeding the Limit? Negotiate with Creditors in Advance

Anyone who exceeds the Chapter 13 limits and who doesn’t qualify for a Chapter 7 filing may consider bringing down debt without relying on bankruptcy.

Communicating with creditors and having a favorable repayment plan created for you is a good idea, if you have steady income and you can afford to return some of the money every single month. A good attorney will guide you through the process and communicate with creditors on your behalf.

Working a solution directly with your creditors can help you stabilize your financial situation. As you bring the debt down, you’ll also become eligible for an eventual Chapter 13 filing in the future.

Debt settlement is a definite option to consider. A good Arizona bankruptcy attorney can make it possible for you to settle for less than what you actually owe. Even if debt settlement isn’t possible, a long-term payment plan will reduce some of the strain and the financial burden.

Do not be afraid to explore the options. To know where you stand right now, you should collect financial information and calculate the amount of debt you’ve accumulated. Having such information will simplify the process of eliminating the options you don’t qualify for and pursuing the best alternatives.